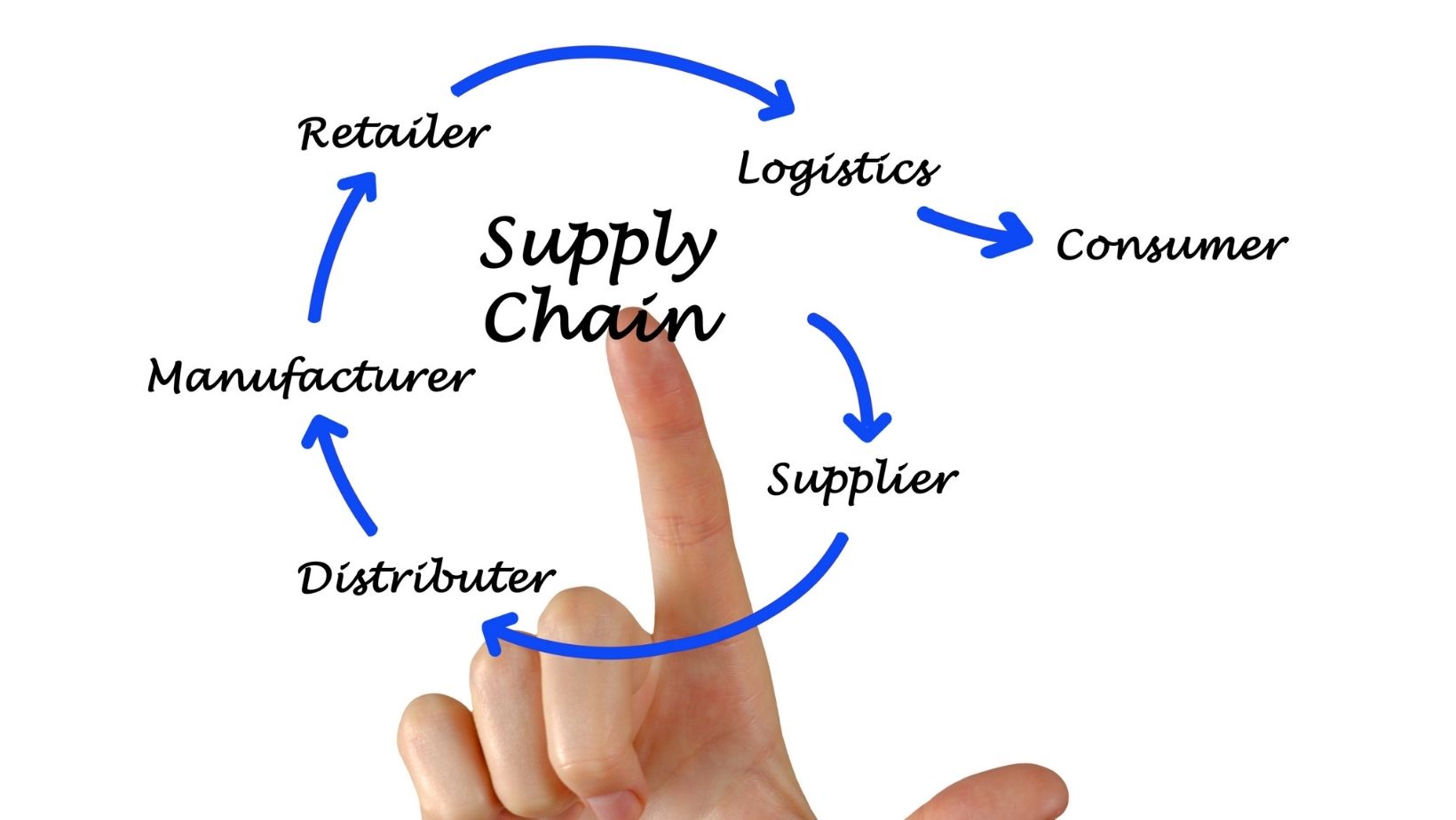

Supply chain finance techniques and instruments

Supply chain finance components are part of a broader set of financing and risk management techniques and practices that enable trade and financial flows throughout the domestic and international supply and distribution chains. The term supply chain finance’ now refers to a wide range of approaches, systems, and solutions used in commerce financing (including international trade). It can relate to a single approach or a full set of strategies and solutions that fulfill the needs of buyers and sellers in increasingly complicated supply chains (particularly when trading on open account terms). The following are some attempts to define, classify, and define supply chain finance methodologies and instruments.

Receivable Based Instruments

Receivables purchase

Receivables purchase is a word that describes and groups together a number of strategies by which suppliers of products and services receive financing by selling all or part of their receivables to a finance company. By assigning title rights relevant to the jurisdiction in question, the receivables will be transferred to the financial provider’s ownership. The seller will get an advance payment for the receivables, which may include a margin or reduction reflecting the quality of the receivables, as well as a finance charge depending on the price agreed upon between the finance provider and the client, upon such a change of ownership. The four main strategies outlined below, as well as a variety of variations, are available for purchasing receivables.

Receivables discounting

Receivables discounting is when a seller of products or services sells a finance provider individual or several receivables (represented by outstanding invoices) at a discount. In emerging markets, the advantages of receivable discounting may be seen across the ecosystem. When regular bank credit is unavailable and sellers must rely on informal and costly credit sources, sellers benefit from a lower cost of working capital credit. Buyers benefit from more dependable suppliers, and sellers who now have another option for covering working capital needs may offer extended credit terms to buyers. Financial institutions that play the role of financiers benefit from a new and less risky way of acquiring MSME customers, potentially creating a virtuous circle in which knowledge gained from working with sellers and their buyers can be used to build a deeper financial service relationship with these actors through additional services.

Forfaiting

Forfaiting is a type of trade finance in which a financial institution buys future payment commitments represented by financial instruments or payment obligations (often in negotiable or transferable form) at a discount or at face value in exchange for a financing charge on a non-recourse basis. The added guarantees of a promissory note (assuming the entity/entities backing the note have sufficient market credibility for the buyer of the instrument) ameliorate challenges to forfaiting in emerging economies due to a lack of collateral. A favorable regulatory and governance framework is also required to make forfait instruments enforceable. Greater communication/conformity between the buyer/seller/financier around the instrument may also be required. Where communication, travel, and a lack of transparency are pervasive, transaction procedures are nevertheless sufficiently manual to make overhead onerous.

Factoring

When a supplier of products or services sells their receivables (represented by unpaid bills) to a financing provider (often known as the “factor”) at a discount, this is known as factoring. The fact that the finance provider is often responsible for maintaining the debtor portfolio and collecting payment on the underlying receivables is a significant distinction of factoring.

Payables finance

Payables financing is supplied through a buyer-led scheme in which vendors in the buyer’s supply chain can obtain funding through the purchase of receivables. The strategy allows a seller of goods or services to receive the discounted value of receivables (represented by outstanding invoices) earlier than their actual due date, usually at a financing cost that is aligned with the buyer’s credit risk. The buyer is responsible for the payment until it is paid in full. Dynamic discounting is a version in which the buyer uses their own cash to settle an invoice or account payable before the original due date. Sellers are provided early payment discounts on bills that are pending payment, which is funded by the customer. The service is dynamic in that the larger the discount, the earlier the payment is made.

Pre-shipment finance

A loan made to a seller of goods and/or services by a financing provider for the purpose of sourcing, manufacturing, or converting raw materials or semi-finished items into finished goods and/or services that are then given to a buyer. In addition to the seller’s ability to perform under the contract with the buyer, a purchase order from an acceptable buyer, or a documentary or standby letter of credit, or a Bank Payment Obligation, issued on behalf of the buyer in favor of the seller, is often a key ingredient in securing the finance. If the lender also needs confirmation of the seller’s ability to finish the agreed-upon work, it can be difficult for the seller to receive pre-shipment financing. This is especially true for newer, unknown businesses or those who operate informally without a track record to back up their claims.

Loan/Advance-based instruments

Loan against receivables

A loan against receivables is funding made available to a party involved in a supply chain on the expectation of repayment from funds generated from current or future trade receivables. It is normally secured by such receivables, but it can also be unsecured.

Distributor finance

Distributor finance is funding provided to a big manufacturer’s distributor to cover the cost of keeping products for resale and to bridge the liquidity gap between the sale of goods to a retailer or end-customer and the receipt of payments from receivables. Limited involvement of anchor parties with limited market knowledge, challenges tracking and coordinating stock and agreements, and means for ensuring repayment of financing rather than the diversion of funds (i.e., accepting distributor financing but using funds from a stock sold to purchase other goods from competing manufacturers rather than repay original financing) are some of the challenges faced in distributor financing in emerging markets.

Loan against inventory

A loan against inventory is a type of financing given to a buyer or seller in a supply chain for the keeping or warehousing of products (either pre-sold, unsold, or hedged) over which the finance provider normally acquires a security interest or assigns rights and exercises some control.

Selling merchandise in a timely manner to meet loan terms can be difficult with a lack of market information. Risks can also be posed by logistics and proper inventory management. By acting as a validator of inventory and offering stock management controls, independent warehousing can help to reduce risk. Because of the lack of transparency in record keeping, buyers and sellers may find it difficult to demonstrate a track record of sales that may be used to determine the possibility of inventory movement required to acquire a loan.

you may also read:

E-Commerce and Supply Chain Finance – Agribusiness Education and Research International

What is Supply Chain Finance? – Agribusiness Education and Research International

What is an agile supply chain in Agribusiness? – Agribusiness Education and Research International

What is Supply Chain Management in Agribusiness? – Agribusiness Education and Research International

Supply chain management and Agribusiness – Agribusiness Education and Research International

Factors Affecting Supply Elasticity – Agribusiness Education and Research International

Contact:

If you have any questions, thoughts, or suggestions, please contact us or join our social media networks.

Email us: [email protected], [email protected]

Feel free to comment:

Your email address will not be shared with anyone.

Join our LinkedIn group

https://www.linkedin.com/groups/13943442/

Join our Facebook group

https://www.facebook.com/groups/agribusinesseducationandresearchinternational

Leave a Reply